Low Interest Rates & Stock Market Gains

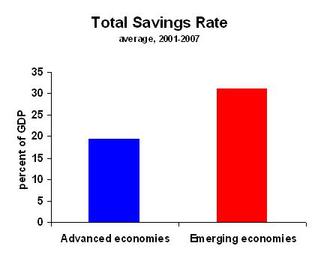

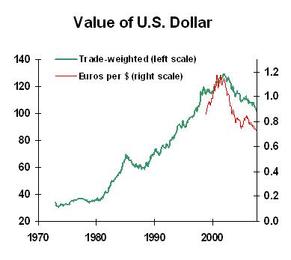

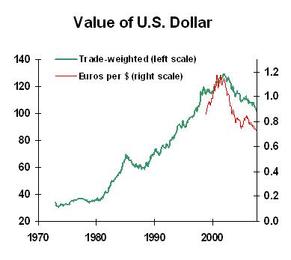

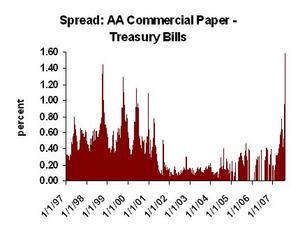

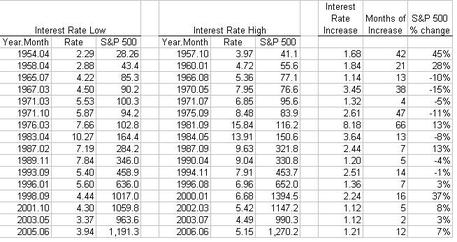

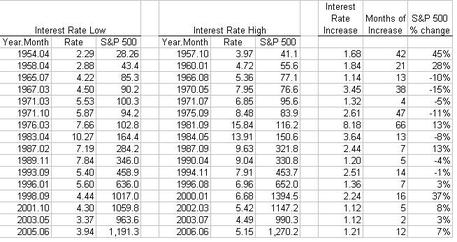

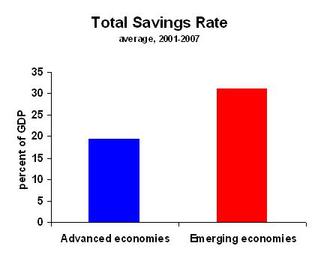

I’m expecting low interest rates and stock market returns over the next five years. Ben Bernanke, before he was Federal Reserve chairman, talked about a global savings glut. Here’s how we get there. The emerging …