The market’s been highly volatile lately. According the CBOE’s VIX index, we’ve seen the most volatile market in the past month. That got me to wondering: are the traders heading off to the Hamptons for the weekend causing this? The story goes like this: the market is a bit skittish, what with credit issues rolling around. So traders sell all their positions before taking a long weekend, then repurchase their positions when they get back to the office. It’s a good story. Most good stories, though, don’t stand up to the data.

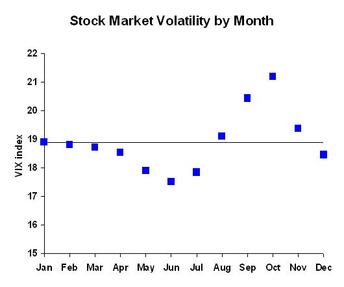

I looked at VIX data back to 1990 and averaged it by month to look for patterns:

August isn’t much above average, but September and October are. December I could understand as window dressing time. Maybe the fall months are changing of the seasons: if an institution has been having a good first half, it’s time to lock in the gains with a safer portfolio. If it’s been having a bad year, time to swing for the fences and try to come back. Still, I’m not satisfied with that story.

Anyone have a better story?