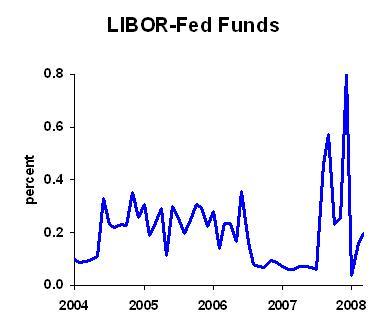

After a huge panic late last year, bankers are again willing to lend money to one another at fairly low interest rates. "LIBOR" is the London InterBank Offered Rate. The spread over Fed Funds widened when banks got very nervous about . . . other banks. Now things aren’t so bad.

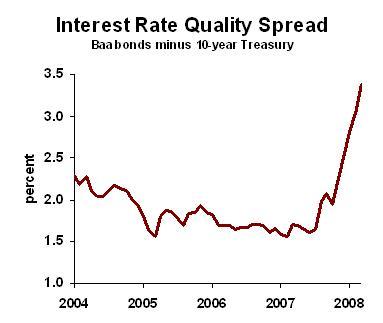

Bond markets, in contrast, have gotten more and more worried about risk. Baa-rated bonds are the lowest quality that is still considered "investment grade."

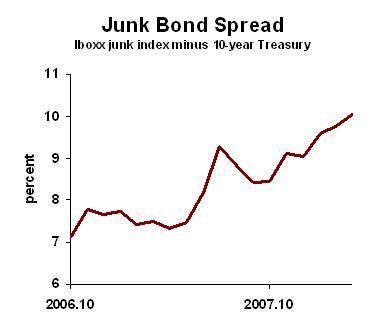

Pure junk bonds are also showing very wide margins. (I have not found a source for junk yields going back before 2006; sorry).

What’s this all mean for the economic outlook? The narrowing LIBOR spread means that financial institutions are much less worried about a near-term financial panic. The widening bond spreads shows there’s still a lot of concern about risk. It’s the old saw that "return OF principal is more important than return ON principal."