Jim Picerno over at Capital Spectator has interesting charts about how risk is priced. Here’s one:

Yes, risky assets now have a much wider spread over treasuries than they did last year. But that was almost entirely because risk earned such low returns last year. Read Jim’s comments about what Mr. Market is–and is not–telling us.

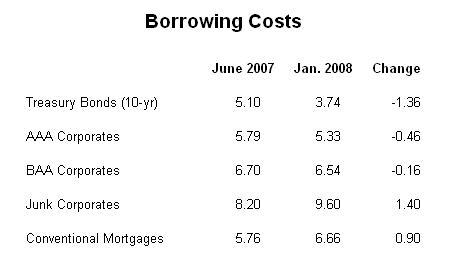

Here’s my own narrow-field view:

It’s cheaper to borrow if you have low risk, like you’re Henry Paulson or Warren Buffett. If you’re credit quality is not pristine, it will cost you more–if anyone will lend to you at all.

What’s this mean for the economy? I still don’t see the "credit crunch" people are talking about. My conversations with bankers and corporate CFOs confirm that aside from the real estate development industry, credit-worthy companies are still able to borrow. It’s hard to have a recession in your economic forecast without the credit crunch.