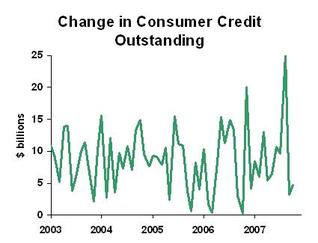

The big worry for the economy today: that the subprime credit problems will spill over to the non-real estate world. It’s not happening yet, however. The data on consumer credit released today shows no change in the trend:

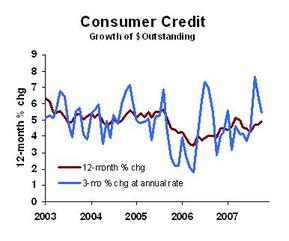

The data are pretty volatile from one month to the next, but it’s clear than we are not suddenly falling off a cliff. Here’s the 3-month annualized and 12 month growth rates:

No reason to think that credit problems have yet spilled over into garden variety consumer credit.

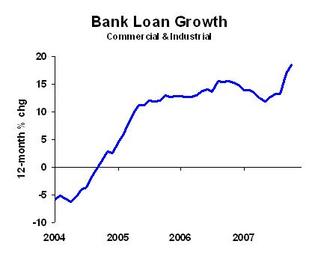

What about business loans other than real estate? Here’s bank commercial & industrial loan growth:

I’ll grant that the greatest risk that could lead to recession right now is a credit crunch. But as of the most recent data, credit is not crunching now.

Business planning tip: plan for a decent 2008, but give a little thought to downside contingencies.