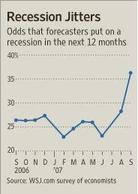

The Wall Street Journal’s survey of economists (subscription required) shows a sharp rise in the probability of recession.

I’m not quite a pessimistic as the panelists, but I agree that there’s a significant chance of a downturn.

What should a business do to prepare for a recession? I see four key steps:

1. Evaluate your vulnerability to recession. Some industries are fairly stable, others very prone to big swings. Know your own business.

2. Set up an early warning system specific to your business, so you are not relying on newspaper headlines, but instead are focusing on the metrics that reflect buyer decisions to purchase your product.

3. Sketch out on one sheet of paper a contingency plan. How might you cut expenses if your sales start to falter? Do you have alternative revenue sources? How can you conserve cash?

4. Manage the business on a day-to-day basis to give yourself the flexibility to implement the contingency plan. Some of the things you considered in preparing your contingency plan may not be immediately available to you, so operate the business in a way that increases your flexibility to handle a downturn.

More details on this topic are in the book, Businomics. Learn more about it here.

(Investors, in a later post I’ll address investing in a recessionary environment.)