The vacancy rate for non-rental housing is astronomical:

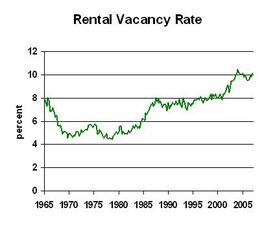

Rental vacancies are also above normal, but they’ve been edging down recently. Vacation homes contribute just a tiny bit of this increased vacancy. Mostly they are houses for sale, many by investors/speculators.

How many houses does this high vacancy rate translate to? Looks like we are about one percentage point above normal, which is about 800,000 houses. Now let’s look at rental vacancy:

Even though there’s been some improvement, rental vacancy looks to be about two percentage points above normal, which is about 700,000 units.

Add together homeowner vacant and rental vacant and we’ve got a 1.5 million housing units vacant ABOVE NORMAL VACANCY RATES.

OK, what’s normal annual demand for new housing? Counting population growth, vacation homes, demolitions and changes in family size, I peg demand at about 1.7 million units. I know that others have estimated demand at 1.6 or 1.8 million units, so let’s be generous and use a high number like 1.8 million. Current housing starts are 1.5 million, plus another 0.1 of manufactured housing, so we’re underbuilding by 0.2 million units a year now. At that pace, we work off the excess inventory in only 7.5 years.

I don’t claim a high degree of precision in these estimates, but they are certainly in the ballpark. And they say quite decisively that the housing problem won’t be over next year, or probably even the year after.

Business planning implications: Stay away from the housing construction supply chain. Look for price declines in markets that are relatively overbuilt and undergrowing.