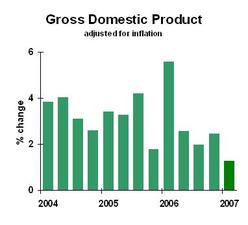

The GDP report was certainly weak at 1.3 percent growth. However, at the risk of sounding like a Republican Pollyanna, it’s not quite as bad as it seems.

Housing construction was very weak, but we all knew it would be. Consumer spending came it ahead of my expectations, so we don’t see any bleed-through from housing.

Surprises (at least to me): non-residential construction was about only mildly positive, exports declined, and federal defense spending was down.

What’s it mean? Looking forward, we can take comfort in consumer spending’s steadiness; we can expect non-residential structures to show a bit more strength, and we can certainly expect defense spending to rebound. (Defense shows a large volatility from quarter to quarter, for reasons I don’t understand. We know the trend is not downward.) We should get back into the 2 percent growth range next quarter, and even higher in the following quarters.

Business planning implications: No panic. Nothing here that makes me raise my estimate of the odds of recession. (There’s still a risk that’s large enough to worry about, however.)