Lots of news and market gyrations. Here’s a quick summary:

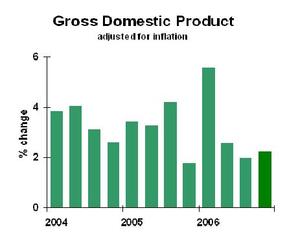

Real GDP for 4th quarter revised downward. This is really just a summation of the all the bad news we’ve received since the first estimate was released a month ago. No real surprise here.

The bottom line on GDP is we’re growing at a slightly sub-par rate, par being about three percent. The four-quarter comparisons look good–so long as we count 2006 Q 1, the last really strong quarter.

We also heard that home sales were down again. No news there, and we continue to think that 2007 will be the last year of decline, not the first year of recovery. The purchasing managers’ index ticked up, indicating manufacturing doing better. That’s the first bit of good news from that sector in a while. Finally, the consumer income and spending data showed good income growth in January, with moderate spending growth. That’s about the best possible combination we could hope for at this time. Finally, total construction spending was down–more old news, given what we already knew about residential construction. The new news was non-residential construction, flat but at a very high level. No problem there.

Now let’s talk financial markets. Wild gyrations, but keep in mind that we’ve had unusually low volatility the last few years. We don’t want this week’s volatility every week, but it’s not unreasonable to expect some big swings once a year.

What to do? For investors, sit tight. If you had cash that you were just about ready to invest, so ahead and buy on the dip. If you liked your previous asset allocation, don’t panic. Sit tight. In a few years’ time, the market will have recovered and the last week of February will have faded from memory.

Business Strategy Implications: Don’t over-react to this week’s news. The outlook is decent aside from residential construction.