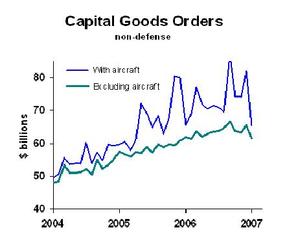

Orders for business capital equipment declined again last month. I’m starting to get nervous:

The airline sector’s orders are highly volatile, so I only look at them over longer time periods. For month-to-month changes, I focus on capital goods orders excluding aircraft, the teal line in the chart above. It peaked last September and is clearly trending down. I’ve been a fan of this sector, given high capacity utilization rates in many industries, the potential for capital spending to lower operating costs, and strong profits and cash flows. I said two months ago, "If business capital spending falters at the same time that housing is cratering, the economy could slow down much more than I’m anticipating."

So after digesting lots of good news over the last few months, let’s dial back the happy-meter and renew our concern about the possibility of slower growth.

Business Strategy Implications: Business that produce equipment and software for other businesses should step up their monitoring of the economy. Step two of my contingency planning process is to set up an early warning system. If you don’t have yours working yet, get going on it.