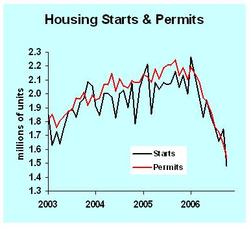

Wow. This is a very steep drop in both starts and permits for new housing starts. (The data shown here include apartment and condo units, but the steepest decline was in single-family homes.)

At the risk of sounding optimistic, we’re getting close to the level of construction that is sustainable, as several of my economist colleagues have pointed out. However, economic variables often overshoot their equilibrium levels, and that’s a real possibility here. Home builders will probably continue to cut back, and their bankers will get increasingly nervous, until it becomes obvious that any home built will be quickly scooped up. That requires a psychological change on the part of buyers that I don’t see happening for another six months. (But my degree is not in psychology.)

Business Strategy Implications: For those in the homebuilding industry, and its supply chain, you’ve been through a serious swing. Your next round of contingency planning should focus on UPSIDE risk. If demand for homes rebounds a bit, like 10% from current levels, are you ready? Do you have the land, financing, and subcontractors in place to get back to growing? That’s a nicer challenge than the downside contingency planning I’ve been urging, but it’s still a challenge.