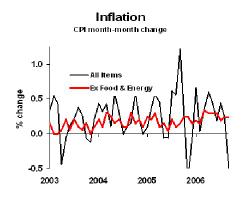

Consumer prices dropped last month, though the "core inflation" rate continued to increase at a high rate.

The sharp drop was due to gasoline prices falling, but we’re seeing "bleed-through" of energy prices into the non-energy sector, as shown by the red line. Time lags keep the core inflation rate running high even when the total inflation rate is dropping. Time lags also explain why the inflation is a problem in a weakening economy. Give it time, and the core inflation rate will come down. (And notice how the Federal Reserve Board members always have their fingers crossed at this time in the cycle, just to make sure that the core rate eventually falls).

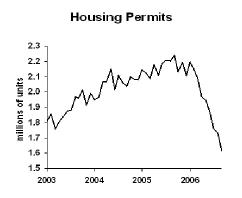

Housing starts showed a little rebound, but permits–which tell us how starts will behave in a few months–continued their decline.

Again, it’s grim in housing land.

Business Strategy Implications: For those of you in the housing supply chain, the headline report on housing starts will announce good news, but don’t believe it. Look at permits. For those companies selling to consumers, it may be time to ease off on price hikes. Watch your sales carefully, and if your current margins are fatter than normal, be ready to cut prices.