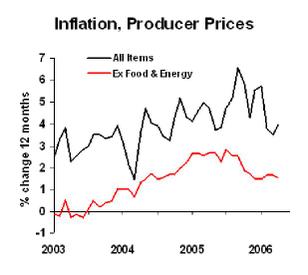

Producer price inflation is surprisingly mild when excluding food and energy. There has been very little "bleed-through" of energy costs into non-energy products.

The crucial question is still what will happen to oil prices.

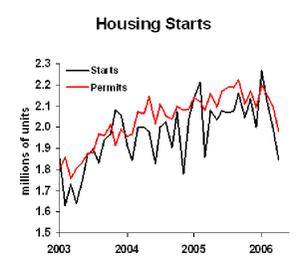

Housing took a dive last month, both in actual starts and in permits for future starts.

This is as expected, though the data jump up and down so much from month to month that some rebound is quite possible. Still, I’m convinced the trend is down a good bit more.

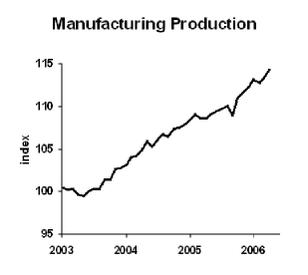

Industrial production grew nicely. Last month’s growth was faster-than-sustainable in the long run, but did not push total capacity utilization up to levels that would threaten to ignite inflation. In other words, it was about as good as news can get.

This news does not tell us clearly what the Fed will do at their next meeting. The inflation numbers are benign, but the industrial production numbers suggest that some tightening wouldn’t hurt, as a preventative measure. Right now it’s a toss up in my mind.

Business Strategy Implications: Manufacturers, and those businesses that serve manufacturers, should make sure they are prepared for even more demand growth, but don’t count on being able to raise your prices much. Companies in the housing-industry supply chain should be very cautious.