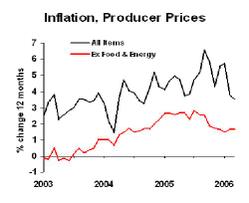

The monthly producer price report showed a sharp increase — 1/2 percent for the month — in total finished goods. That’s the bad news. The good news is that energy price hikes didn’t really bleed through to core inflation. Finished goods prices excluding food and energy rose just 0.1 percent. The 12-month growth rates are fairly benign:

The greatest uncertainty for corporate costs is commodities, ranging from oil through gold and copper. We’ll post more on that topic later today. The March data showed declines in prices for crude materials and intermediate materials. (These are stuff that need further processing before they can be sold to their final users.) That bodes well for finished good prices in the coming months. However, the recent April data on commodities indicate price hikes coming in next month’s report for crude materials, which will feed into finished goods prices in a few months.

Business strategy implications: Look for roller-coastering costs in the coming months. Don’t overreact, but expect sharp swings both up and down. This is not a good time to make a major investment predicated on continued price hikes in your inputs; instead, look to manage a very volatile cost cycle.