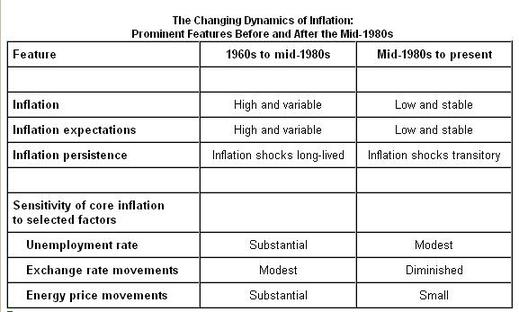

Inflation is not like it used to be. Federal Reserve Board member Randall Kroszner gave a speech earlier this year that pretty clearly lays out the differences. Here’s his basic table:

The interesting issue is why the change. Kroszner points to two related differences between now and then. First, the Federal Reserve (and other central banks around the world) has worked to get inflation low, and then to keep it low. Second, market participants have come to expect inflation to stay low. Kroszner throws in some other explanations, but to me he’s just covering his bases. The change in monetary policy is the key.

Business Strategy Planning Implications: Don’t expect a persistent increase in inflation, even if you see oil prices rising, the unemployment rate falling, or the dollar falling. Whatever changes in the inflation rate that we see are most likely transitory.