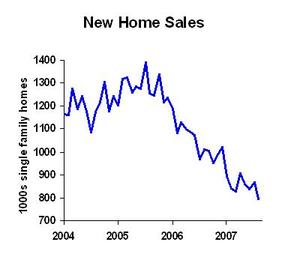

Today’s news was ugly for homebuilders:

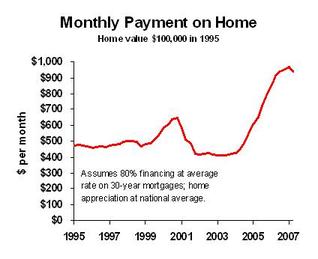

Is it going to get any better? Here’s a way to look at it. Consider a hypothetical house that would have sold for $100,000 back in 1995. Now every three months let’s ask ourselves, if that house were purchased today, what would be the monthly payment? (Assume 30-year fixed rate mortgage on 80% of home price.) The payment depends on both home price and mortgage rate. Here’s the picture:

(That’s the national picture; not hard to adjust it for your state or metropolitan area.)

The dip in 2001-2004 enabled many first time home-buyers to get their house a couple of years earlier than they otherwise could have moved out of rental housing. We pushed home ownership rate to all-time record highs, in essence borrowing sales from the future.

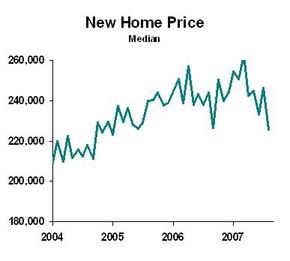

Now, however, home prices are too high for affordability, even though mortgage rates are still low. The young family who would normally have bought their first home in 2007 already bought a house, probably back in 2005. And investors are out of the market because . . .

Home prices don’t seem to going up. But prices are still too high to make owning a rental unit a positive cash flow investment.

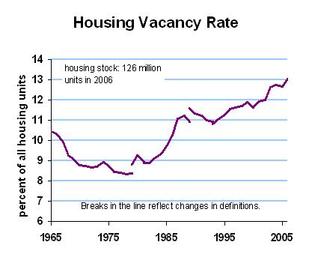

And in case anyone is still in a good mood, it looks to me like our overall housing vacancy rate is about 1.25 million units above healthy–and that’s taking an optimistic view of what’s healthy.

Now repeat after me: the next time there’s a boom, I will not buy in at the top.