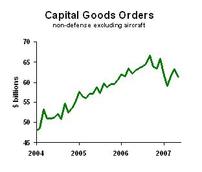

Business executives are skittish, according to the latest data on durable goods orders. Although the fundamentals for capital spending are good, behavior doesn’t match:

This is important because at this time, the economy can only handle one big problem without going into recession. The one big problem is, of course, the collapse of residential housing. If capital spending goes into the tank, that could be big enough to feed over into consumer spending, pulling the economy into recession. I’M NOT FORECASTING RECESSION at this point, but my worry level is a bit higher after this morning’s data.

The utilization of existing capacity is not low, except in some sectors. There are still plenty of opportunities for businesses to save money through capital expenditures that automate what are now manual processes. And financial conditions are good, with profits holding up and debt equity ratios pretty low. So to what do I attribute the weak capital goods orders? I’m sorry you asked, because I have to fall back on the least satisfying possible answers: Skittishness. Psychology. Worry. Fear.

I’m not changing my economic forecast at this time, nor am I recommending revisions of business planning results that currently drive corporate strategy. But I do recommend building in some flexibility to deal with a possible downturn in economic growth, and even a possible recession.