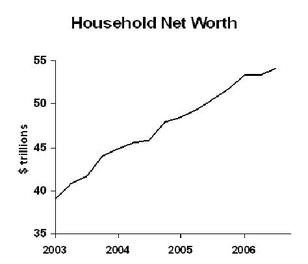

Just got around to taking a look at the quarterly Flow of Funds data from the Fed. It’s a royal pain to work with their data, but here’s the link. Two interesting results from the third quarter data. First, household net worth set record high.

Home prices contribute a lot to this, and stock prices help, too. Note that if families were taking out ALL the equity gains from their homes and spending the money, net worth would not be growing. Looking behind these numbers, total debt was growing, but assets grew even more. This is one reason why I’m comfortable with a moderately good forecast for consumer spending.

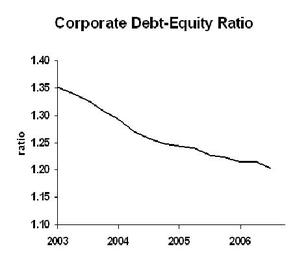

Second conclusion: corporate balance sheets are stronger. As on the household side, net worth is up. Here’s corporate debt-equity ratio:

Business Strategy Implications: Balance sheets will support continued spending by consumers and businesses.

Other Blogs Posting on This Topic: Prudent Bear has cooler charts than mine, and a lengthy discussion arguing that we’re in an unsustainable liquidity bubble (charts at the top, then scroll down half way for "flow of funds" discussion); Calculated Risk discusses use of the data to estimate Mortgage Equity Withdrawals; the squarehead Stefan Karlsson uses the data to figure that home equity as a percentage of home assets has hit a low; John Silvia looks at the corporate side and agrees with me; Mike Simonsen of Altos Research observes that net financial worth (excludes home assets, but counts mortgage debt) rose last quarter.