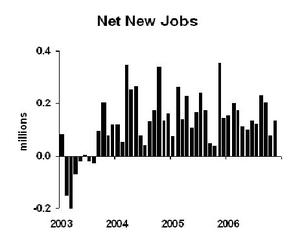

Job growth was moderate last month, reflecting a moderate underlying demand for labor, plus some constraint due to tight labor markets in many parts of the country.

There’s nothing to complain about in the aggregate. The growth rate over the last three months is 1.2 percent (annual rate), which is a little faster than population growth. Given that some businesses that are trying to expand cannot find people with the right skills, and some available workers have skills for companies that are not trying to expand, the labor market is limiting growth of total employment. It’s a problem, but much better than having weak aggregate demand for labor.

Looking for bad news? Both construction and manufacturing jobs declined last month. These sectors are watched more closely than service jobs because they are swing sectors, much more volatile. We never see recessions emanating from the health services sector, but we do see them coming out of construction and manufacturing. That said, bear in mind that we can have expansion of the overall economy while these two sectors contract–so long as their contraction is mild. So far, so good.

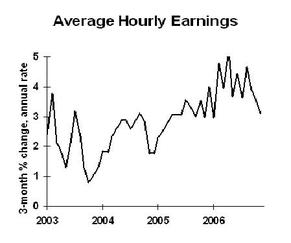

Inflation pressures? Looks like the worst of the wage pressure is behind us for this cycle.

Business Strategy Implications: No sign of recession across the economy as a whole, but contractors and manufacturers should check their customers’ behavior in real time. Wage cost pressures may be easing up, but labor markets are still tight. We’ll post on how to find employees in this market in the next day or two.

Other Blogs Posting on This Subject: Calculated Risk pays more attention to retail trade jobs than I do; BizzyBlog has good comment on upward revision of September data, and the American Shareholders Association gives more credence to the household survey than the establishment survey (which I chart above), a view I don’t share but which is worth considering.