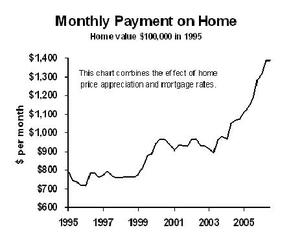

Mortgages are still pretty cheap, but home prices have risen significantly over the past few years. I got curious how these two effects combined to change monthly mortgage payments. Here’s the chart:

I started with a hypothetical home priced at $100,000 in 1995 first quarter. I had the home appreciate in value in proportion to the OFHEO’s House Price Index, the best measure of changes in the value of existing homes. For each quarter, I calculated monthly payments on this home price for a 30-year mortgage at the average mortgage rate calculated by the Federal Reserve.

From 2000q2 through 2003q2, the decline in mortgage rates dominated. Since then, home price increases have overwhelmed mortgage rates. Over the last four quarters, this monthly payment measure has risen over 17 percent. And that’s for the same hypothetical house.

Business Strategy Implications: Look for first-time home buyers to be priced out of the market in 2007. Move-up buyers will do OK, because they are selling an appreciated home. And a few first-timers will buy next year, desperate to get in the market. But the value proposition, and ability to make payments, doesn’t look so hot. So those of you in the homebuilding food chain, be wary of next year. But note that local markets will vary.