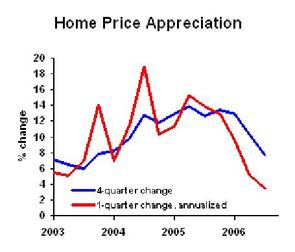

Home prices rose last quarter, but at the slowest pace since 1998.

The housing boom is certainly over. There’s a fair chance that we’ll see further declines in the coming quarters. The biggest effect, though, is that investors will likely decide that this sector is over as a great play. That will put more investor-owned homes on the market, further depressing prices.

Note on the data: This data series is the best out there. They gather data from Fannie Mae and Freddie Mac on homes that have recently sold; Fannie and Freddie have the data if the new mortgage went through them. Then they look in their old records and see if the same house had sold in a previous year. When they get a match, that’s a data point reflecting a percentage appreciation over some time period. They have millions of these data points, and then find the path for their index that best matches the data. This is a better approach than simply looking at median or average prices, because such measures can be distorted by the mix of homes sold.

Business Strategy Implications: Contractors should check their regional indexes (at OFHEO) to evaluate local conditions. Nationally, housing construction will be weak for over a year, and the residential construction supply chain should hunker down.

Other Blogs Posting on This Topic: Divagator comments on this and other recent data, anticipating a significant slowing of the economy early next year; Paper Money comments on this data and adds an easy tool for looking at the data, which includes state and metro area seres.