The New York Times recently reported:

"Of the companies receiving their first ratings from Standard & Poor’s this year, fewer than 10 percent received investment grade.

The median rating for all American nonfinancial companies is now BB, or relatively high-quality junk. A decade ago, the median rating was BBB, an investment grade rating."

(Thanks to Calculated Risk for the pointer.)

I can’t help but wonder if more companies are getting ratings that wouldn’t have bothered getting ratings some time back. The Times also says, "Much of that money is seeking higher returns, and is thus willing to accept higher risks. That willingness to buy has meant that borrowers with dubious credit end up paying relatively little for the money."

So it’s quite possible that the lower spread between junk debt rates and investment grade debt has led more companies with junk-level financials to access the bond markets. That does not mean that business is getting any riskier.

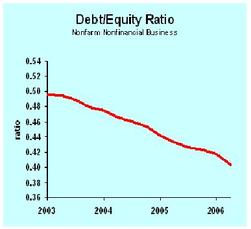

Here’s another approach to the question. The Federal Reserves flow of funds data can be used to calculate debt-equity ratios. Here’s a picture:

(Note that equity is given at market values, so these are not comparable to the debt-equity ratios you’d see reported for individual companies.)

This looks pretty cool. The flow of funds data also show an eight percent increase in cash holdings over the last four quarters. Sounds healthy to me.

Business Strategy Implications: Don’t worry about massive bankruptcies among corporations. A few companies will show their bellies to the sky, but most are in good condition. If you absolutely must worry, you should worry about overextended homeowners and small real estate investors.