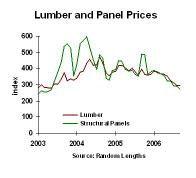

Lumber prices have dropped sharply in the last year. We use data from Random Lengths:

There are two stories at work. The first is the basic commodity cycle that we’ve described in general terms, and specifically with respect to oil and steel. In short, high prices lure producers to install greater capacity.

The second story we’ve also discussed: the falling housing market. Which still has more distance downward to go.

Before giving up on lumber entirely, though, it’s worth remembering that housing construction is not the only use for the product. Non-residential construction uses a fair amount, and this sector is strong. Next time you see workers pouring concrete, look at the forms into which the concrete goes. There’s also a substantial industrial demand, for crating. To gauge this usage, monitor overall industrial production. (It was down in August, after strong gains in preceding months. Probably flat in September, but data won’t be released for a couple of weeks.)

The outlook for lumber prices is probably weak. Just can’t avoid it when housing is collapsing.

Business strategy implications: Producers should hunker down, consumers should expect further price weakening.