Today’s personal income and consumer spending report adds to my worries.

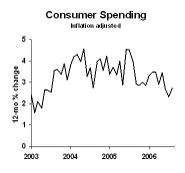

Note that it’s the growth rate of consumer spending that’s slowing, not the actual number of dollars spent. And the chart is adjusted for inflation.

Looks to me like consumers are no longer buoyed by their home price appreciation and mortgage refinancings. The current growth rate is sustainable–it’s roughly in line with growth of disposable income. But, it’s vulnerable if income growth slows, and it’s vulnerable if panic sets in as a result of the housing downturn. I’m still not forecasting recession, but I’m a little more worried each day.

Business strategy implications: Keep working on the contingency planning.