Consumer prices rose at the upper end of their recent range of growth rates. This is not an alarming report, but neither is it comforting.

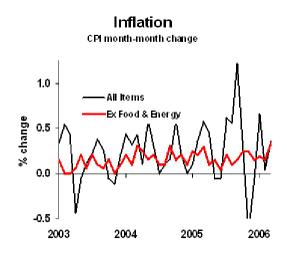

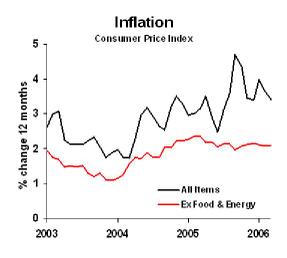

The "all items" index is quite volatile as energy cost increases react to crude oil prices. The "Ex. Food & Energy" or core inflation rate is more stable. A recent study actually showed that this core rate is more indicative of future inflation than the total rate. The reason: food and energy price changes tend to be transitory. So for most purposes, using the core inflation rate makes sense. I like to look at the figures using 12-month percent changes to smooth out the month-to-month gyrations:

This indicates that inflation is not a serious problem at this time, and while it’s higher than the Federal Reserve would like, a core inflation rate of two percent isn’t that bad.

Business strategy implications: 1) it’s not as easy as the headline figure suggests to pass cost increases along to your customers. 2) inflation is not such a great problem that the Fed will keep pushing short-term interest rates up at the pace they have done in the recent past.

By the way, there’s a short section of my forthcoming book, Businomics: How to Grow Profits Throughout the Economic Cycle, that deals with passing cost increases along to your customers. Email me if you’d like to see that section now, rather than wait for the book’s 2007 publication.